Stefon Walters, The Motley Fool

·4 min read

There are two main ways to make money from stocks: price appreciation and dividends. The former is the most straightforward, but the latter can be a significant part of investors' total returns.

On the surface, it makes sense that dividend-seeking investors would naturally go for the companies offering the highest dividend yields, but a company's dividend yield by itself doesn't tell the full story. Other business factors should be considered.

Below are the S&P 500's three highest-paying dividend stocks currently. Of course, dividend yields change as stock prices change. However, all three are routinely some of the S&P 500's highest yielding stocks. So does that make them good investments? Let's take a look.

Company | Dividend Yield |

|---|---|

Altria Group (NYSE: MO) | 9.02% |

Devon Energy (NYSE: DVN) | 6.73% |

AT&T (NYSE: T) | 6.35% |

Data source: Google Finance. Dividend yields as of March 27.

1. Altria Group

Altria is America's largest tobacco company, owning popular brands like Marlboro, Black & Mild, and Copenhagen. The stock has lagged recently, but this year has been a slight turnaround for its investors, with the shares up over 5% year to date. Still, the company's total returns are just around 16% in the past five years, which isn't something to write home about.

Many investors have reservations about investing in a tobacco company because of its societal harm, so Altria has traditionally offered an ultra-high dividend yield to attract and retain investors. It's routinely at the top of the pack of the S&P 500's highest-paying dividend stocks.

The biggest concern with Altria is the falling smoking rate among U.S. adults. This has a tangible effect on its sales volume. Luckily, the company has been able to use its pricing power to offset dropping sales volume.

The company has to find a viable alternative to its cigarettes to maintain its long-term investment appeal, but it has the resources to continue returning shareholder value (by dividends and share buybacks) for the foreseeable future while it works this out.

2. Devon Energy

Devon Energy is an energy company specializing in oil and natural gas exploration, development, and production. It has a unique dividend structure that you don't see often. Instead of a base yearly amount paid out in quarterly installments, the company has a base dividend amount and a variable amount based on its latest cash flow. The current base dividend is $0.22, and the total is $0.44 per share.

Devon Energy's current quarterly dividend is a little less than its average over the past five years, but that's mostly because of high oil prices in 2022 that boosted the company's cash flow much higher than normal.

Dividend aside, Devon Energy has done well at optimizing its operations to become more efficient. This year, it plans to spend around 10% less to maintain its current production. Add that with its improving drilling efficiencies, and Devon Energy is headed in the right direction.

3. AT&T

After years of well-documented missteps (namely, its media and entertainment ambitions), AT&T seems to be getting back to its core telecom businesses.

Despite slashing its dividend in half in 2022, AT&T continues to offer one of the higher yields in the S&P 500. While many investors appreciate this benefit, others have had reservations about investing in AT&T because of questions about the dividend's stability. It makes sense, considering that the dividend is the main appeal of investing in the telecom giant.

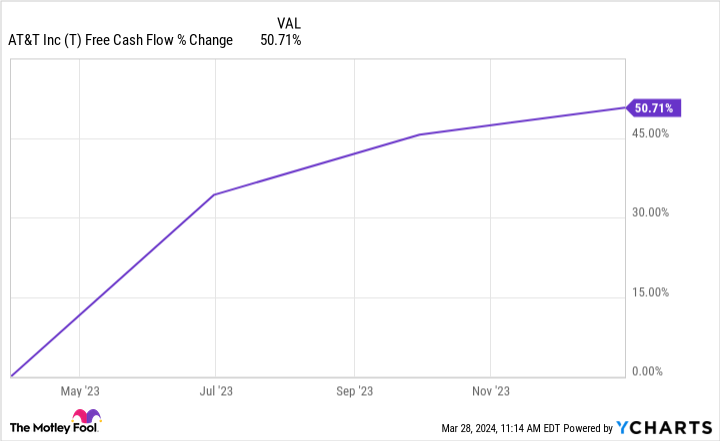

Concerns about AT&T's dividend have mostly eased, though, as the company's free cash flow has surged in the past year.

I think it's important to focus on AT&T's free cash flow because it provides a clearer picture of the company's financial health and ability to sustain or increase dividends and cover debt obligations. AT&T expects its 2024 free cash flow to come in between $17 billion and $18 billion, which is more than enough to cover both.

Telecom is an industry that's becoming increasingly more important as the world becomes more digitally connected and reliant on technology, both personally and professionally. Because AT&T is one of the top players in the field, I'd feel comfortable holding on to it for the long haul.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service hasmore than tripledthe return of S&P 500 since 2002*.

*Stock Advisor returns as of April 1, 2024

Stefon Walters has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Should You Buy the 3 Highest-Paying Dividend Stocks in the S&P 500? was originally published by The Motley Fool