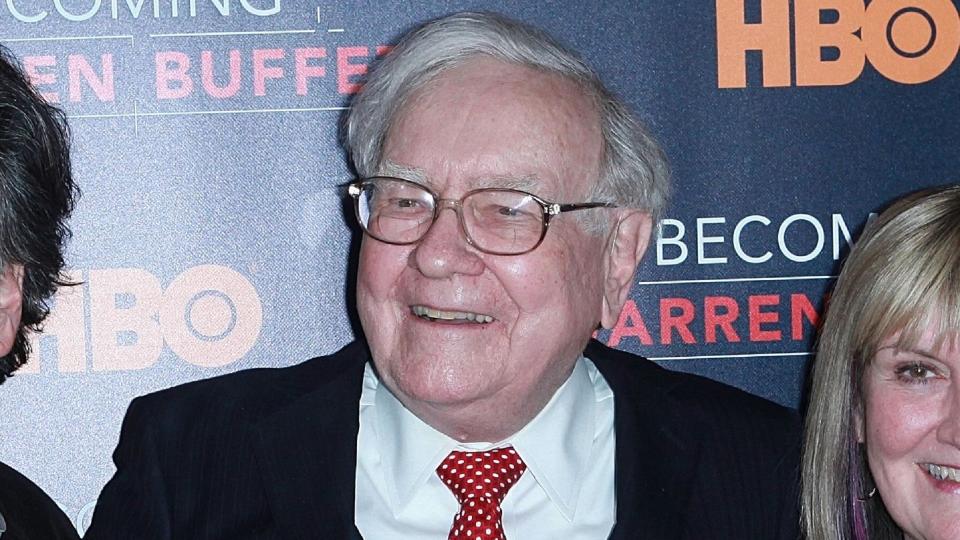

Warren Buffett’s Berkshire Hathaway recently released its investments for the fourth quarter of 2023 — an event investors are always eagerly awaiting, seeking clues as to where the Oracle of Omaha puts his money.

Check Out: 8 Best Cryptocurrencies To Invest In for 2024

Read Next: 6 Genius Things All Wealthy People Do With Their Money

The filing usually also triggers much speculation as to what the conglomerate’s “mystery stock” might be.

Yet, in the latest 13F filing of Feb. 14, Buffett once again requested confidential treatment from the Securities and Exchange Commission (SEC). Berkshire Hathaway omitted “one or more holding(s)” from the public filing.

Learn More: 10 Valuable Stocks That Could Be the Next Apple or Amazon

Sponsored: Owe the IRS $10K or more? Schedule a FREE consultation to see if you qualify for tax relief.

Form 13F: What Does it Mean?

A form 13F is required to be filed within 45 days of the end of a calendar quarter for managers with more than $100 million in assets under management, according to the SEC. A manager can request to withhold information if, for example, the reportable security is likely to be substantially harmed by public disclosure of Form 13F data.

Or, in other words, “the goal is to prevent copycat buyers from also digging into a stock Berkshire is accumulating because the additional demand would raise its price, forcing Buffett & Co. to either spend more or cut back on their planned purchases,” CNBC detailed.

“The recent unveiling — or lack thereof — of Berkshire Hathaway’s mystery stock in its 13F filing is more than a headline; it’s a masterclass in strategic disclosure and investment prudence,” said Staci LaToison, founder and CEO of Dream Big Ventures as well as the host of the Her Money Moves podcast. “Buffett’s legendary track record, underpinned by a blend of astute analysis and unwavering fiduciary duty, starkly contrasts with the cautionary tales of flashier investment schemes, exemplified by FTX’s fall from grace.”

The filing offered an abundance of information as to what he added — and what he trimmed — during this latest quarter. As for the so-called “mystery stock,” the omission, as is often the case, fueled the rumor mill.

As Robert R. Johnson — PhD, CFA, CAIA, and professor of finance at the Heider College of Business, Creighton University — noted, following the moves of Buffett and his colleagues at Berkshire Hathaway over the years has been a winning strategy.

“Some people think you need to get the exact timing correct to be successful in investments — a mistaken notion,” added Johnson, himself a longtime Berkshire Hathaway shareholder. “Had one mirrored Mr. Buffett’s moves when they became publicly available following the release of the 13Fs, one would have done quite well.”

What Did Warren Buffett Sell?

The stock he trimmed which made the most headlines was Apple. Yet, it’s still Berkshire’s top holding.

“The truth is that Berkshire sold only a little over 1% of its Apple shares,” said Johnson, noting that Apple represents a whopping 45.2% of its marketable securities portfolio. “This is a rousing endorsem*nt of Apple as an investment. The fact that it held nearly 99% of its position indicates that the Berkshire brain trust believes it still represents an excellent value.”

In addition, Berkshire completely eliminated its stake in homebuilder D.R. Horton.

“It [D.R. Horton] had a gangbusters year in 2023, rising from just over $90 to $151 per share,” noted Peter C. Earle, senior economist with the American Institute for Economic Research. “Regardless of how long they’d held that issue before 2023, a 68% gain in 12 months on top of whatever other profits they’d booked was enough for them to flatten the position.”

Earle also noted that Berkshire sold StoneCo Ltd., a firm it took a stake in starting with the October 2018 initial public offering (IPO).

“From the $24 per share IPO, the stock rose as high as $92 per share in February 2021,” said Earle. “But since those highs the stock has fallen, spending the last 18 months below its IPO price at between $8 and $15 per share.The stock has been a lousy performer since 2022 and may represent a rare loser among Berkshire’s usually high-quality picks.”

In addition to D.R. Horton, Berkshire reduced its stakes in HP and Paramount Global as well.

“Based on Berkshire’s sales of these equities, I recommend investors look elsewhere to invest their money,” said David Kass, clinical professor of finance at University of Maryland’s Robert H. Smith School of Business.

What Did Buffett Buy?

Buffett notably added to Berkshire’s stakes in Chevron, Occidental Petroleum and Sirius.

According to Kass, Berkshire also revealed in its 13F that it had added about $2 billion — or 14% — to its stake in Chevron.

“That was its largest purchase during Q4 (other than the mystery stock) and I would recommend it as a conservative investment yielding a 4% cash dividend along with a large stock buyback program,” said Kass.

And finally, Berkshire significantly increased its weighting in financial services stock, which could indicate a view that interest rates have hit their highs for this cycle — and that the Federal Reserve will lower rates sooner rather than later, according to Earle.

“And consequently, that the financial performance of banks and insurance firms will improve from here,” he added.

What Is Warren Buffett’s Mystery Stock?

“My guess for the ‘mystery stock’ in Berkshire’s portfolio is JPMorgan Chase,” said Kass.

He argued that Berkshire’s 10Q filing for the third quarter of 2023 indicated an unexplained purchase of $1.2 billion of “banks, insurance and finance” stock.

“Buffett has always admired Jamie Dimon and has praised him frequently,” Kass continued.

Kass further noted that Berkshire’s investment officer, Todd Combs, has been on JPMorgan’s board of directors since 2016 — and that JPM is generally acknowledged to be the best managed and most profitable bank.

“In recent years it has substantially outperformed Berkshire’s investments in Bank of America (second largest holding after Apple) and Citigroup,” added Kass. “A 5% stake in JPM would currently equal $26 billion which would ‘move the needle’ for Berkshire and would qualify as an ‘elephant’ that Buffett has been seeking.”

On a macro level, the decision to follow in Buffett’s footsteps is less about chasing revelations and more about embracing a philosophy of value, diligence and long-term growth, said LaToison.

“In a world captivated by the next big thing, Buffett’s methodical approach reminds us that true wealth is built on the foundation of responsibility, not the endorsem*nts of the moment,” she added.

More From GOBankingRates

I'm a Self-Made Millionaire: 5 Stocks You Shouldn't Sell

Costco: 9 Best Clothing Deals in February 2024

What Makes a Good Bank in 2024, According to a Banking Expert

Carrying a Credit Card Balance? Consider This Easy Strategy to Pay It Off

This article originally appeared on GOBankingRates.com: Warren Buffett’s Mystery Stock: 4 Expert Takes on What You Should Buy