What is the most popular asset allocation strategy?

The most common dynamic asset allocation strategy used by mutual funds is counter-cyclical strategy. These funds increase their equity allocation (reduce debt allocation) when equity valuations decline (become cheaper) and reduce debt allocations.

You can consider investing heavily in stocks if you're younger than 50 and saving for retirement. You have plenty of years until you retire and can ride out any current market turbulence. As you reach your 50s, consider allocating 60% of your portfolio to stocks and 40% to bonds.

By just adding a bit of gold to your portfolio, say 10–20 percent, your portfolio can deliver better returns. Thanks to strong equity performance in 2021 and 2023 and also gold's run in 2023, the 70-20-10 (equity-debt-gold) combination has topped the charts.

Income, Balanced and Growth Asset Allocation Models

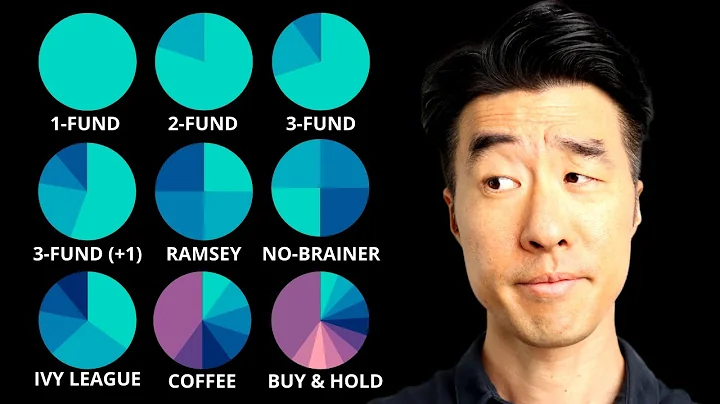

We can divide asset allocation models into three broad groups: Income Portfolio: 70% to 100% in bonds. Balanced Portfolio: 40% to 60% in stocks. Growth Portfolio: 70% to 100% in stocks.

Short-term investors or those with low risk tolerance would do best with a portfolio containing 50% bonds and 50% stocks. Keep in mind when rebalancing your portfolio that buying and selling investments can incur transaction costs, plus there will be tax considerations on sales.

A common asset allocation rule of thumb is the rule of 110. It is a simple way to figure out what percentage of your portfolio should be kept in stocks. To determine this number, you simply take 110 minus your age. So, if you are 40, then the rule states that 70% of your portfolio should be kept in stocks.

The common rule of asset allocation by age is that you should hold a percentage of stocks that is equal to 100 minus your age. So if you're 40, you should hold 60% of your portfolio in stocks. Since life expectancy is growing, changing that rule to 110 minus your age or 120 minus your age may be more appropriate.

At age 60–69, consider a moderate portfolio (60% stock, 35% bonds, 5% cash/cash investments); 70–79, moderately conservative (40% stock, 50% bonds, 10% cash/cash investments); 80 and above, conservative (20% stock, 50% bonds, 30% cash/cash investments).

Strategic asset allocation (SAA) is constructed on the basis of long term asset class forecasts with targets to maintain a set combination of asset classes. Dynamic asset allocation (DAA) is an active strategy that adjusts the allocation of assets based on medium term views.

Next, use the following rule of thumb: Subtract your age from 100 and put the resulting percentage in stocks; the rest in bonds. In other words, if you're 20 years old, put 80% of your assets in stocks; 20% in bonds.

What is the average annual return if someone invested 100% in stocks?

The average stock market return is about 10% per year, as measured by the S&P 500 index, but that 10% average rate is reduced by inflation. Investors can expect to lose purchasing power of 2% to 3% every year due to inflation.

For many financial goals, investing in a mix of stocks, bonds, and cash can be a good strategy. Let's take a closer look at the characteristics of the three major asset categories. Stocks - Stocks have historically had the greatest risk and highest returns among the three major asset categories.

Typically, balanced portfolios are divided between stocks and bonds, either equally or with a slight tilt, such as 60% in stocks and 40% in bonds. Balanced portfolios may also maintain a small cash or money market component for liquidity purposes.

- High-yield savings accounts.

- Certificates of deposit (CDs) and share certificates.

- Money market accounts.

- Treasury securities.

- Series I bonds.

- Municipal bonds.

- Corporate bonds.

- Money market funds.

- Stocks.

- Real Estate.

- Private Credit.

- Junk Bonds.

- Index Funds.

- Buying a Business.

- High-End Art or Other Collectables.

At the moment, no two next-big-thing investment trends are garnering more attention than electric vehicles (EVs) and artificial intelligence (AI). According to Fortune Business Insights, the global EV market is estimated to grow by nearly 18% on a compound annual basis through 2030.

Determining your asset allocation is crucial. A common rule of thumb is to subtract your age from 100 to determine the percentage of your portfolio that should be allocated to stocks. The remaining percentage can be allocated to less volatile investments like fixed deposits, bonds, or government schemes.

It's relatively simple: You add up all of your investments, and withdraw 4% of that total during your first year of retirement. In subsequent years, you adjust the dollar amount you withdraw to account for inflation.

The Rule of 120 (previously known as the Rule of 100) says that subtracting your age from 120 will give you an idea of the weight percentage for equities in your portfolio.

Conventional wisdom holds that when you hit your 70s, you should adjust your investment portfolio so it leans heavily toward low-risk bonds and cash accounts and away from higher-risk stocks and mutual funds. That strategy still has merit, according to many financial advisors.

What is a 70 30 investment strategy?

A 70/30 portfolio is an investment portfolio where 70% of investment capital is allocated to stocks and 30% to fixed-income securities, primarily bonds.

While both CDs and bonds are generally safe investments, both carry their own risk factors. CDs face inflation risk, while bonds face interest rate risk. Investing in a mixture of both can help hedge your investments. You may see greater returns with high-yield bonds if you're more risk-tolerant.

Retiring on $500,000 may be possible, but it probably won't be easy. In addition to aggressive saving and strategic investing, you'll need to be honest about your needs and thoughtful with your spending.

Conventional wisdom holds that when you hit your 70s, you should adjust your investment portfolio so it leans heavily toward low-risk bonds and cash accounts and away from higher-risk stocks and mutual funds.

- FDIC-Insured High Yield Savings Account. ...

- Fixed Annuities. ...

- US Treasury Securities. ...

- Employer-Sponsored Retirement Plan. ...

- Individual Retirement Accounts (IRAs) ...

- Money Market Accounts. ...

- Low-Cost Index Funds.