What is a savings account for beginners?

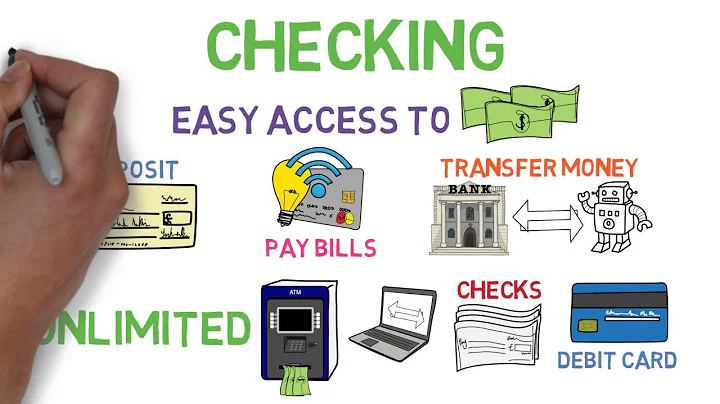

A savings account is a deposit account designed to hold money you don't plan to spend immediately. This is different from a checking account, a transactional account meant for everyday spending, allowing you to write checks or make purchases and ATM withdrawals using a debit card.

This is the most basic type of account you can open at any bank. A Savings Account, by definition, allows you to deposit your money, safe with the bank, so you don't have to carry it around with you or hide it in that rusted old steel safe at home. Don't worry, you can withdraw these funds when you need them.

You can open a savings account at a bank or credit union and deposit money into the account. The bank then pays you interest on your balance. You can continue adding money to savings, usually through one or more of these methods, depending on the bank: Cash or check deposits at the ATM.

Traditional savings account: Best if you want to bank in person. High-yield savings account: Best if you want to bank digitally. Money market account: Best if you want a debit card or paper checks tied to your savings. CD: Best if you're comfortable not touching your money for a long time.

A savings account is a good place to keep money for a later date, separate from everyday spending cash, because it offers safety, liquidity and interest-earning potential for your funds. These accounts are a great place for your emergency fund or savings for shorter-term goals, such as a vacation or home repair.

Savings are money or income not spent and put into accounts to accumulate. Explaining this concept to kids is tricky, especially if they can't see money growing week by week. What will help is to explain savings with a real-world example.

A savings account is a safe place to put your money when you can't afford to lose any or think you'll need it in an emergency. It's also a good place to put some of your investments as a hedge against losses – you can't lose everything if some of your money is in an ordinary savings account, after all.

Savings account benefits include safety for your savings, interest earnings and easy access to your money. However, savings accounts may have drawbacks, such as variable interest rates, minimum balance requirements and fees.

Among the disadvantages of savings accounts: Interest rates are variable, not fixed. Inflation might erode the value of your savings. Some financial institutions require a minimum balance to earn the highest interest rate.

Interest on savings accounts is expressed in percentage terms. For example, let's say you have $1,000 in the bank; the account might earn 1% interest. Unfortunately, most banks pay less than 1% interest on savings accounts due to historically low-interest rates.

How much money should you start with in a savings account?

The standard recommendation is to have enough to cover three to six months' worth of basic expenses.

Many banks require a minimum initial deposit, often from $25 to $100, but others have no minimum deposit requirement. Even if you don't have to fund your account when you first open it, you're better off depositing money sooner rather than later. That way, you'll be able to start earning interest sooner.

If you don't need the money for at least five years (or longer) and you're comfortable taking some risk, investing the funds will likely yield higher returns than saving. If you're eligible for an employer-match in your retirement account such as a 401(k).

Checking accounts are better for regular transactions such as purchases, bill payments and ATM withdrawals. They typically earn less interest — or none. Savings accounts are better for storing money. Your funds typically earn more interest.

Yes. You can withdraw from your savings (after all, it is your money), but keep in mind that some banks may have monthly withdrawal limits. But there's no limit to the number of times you can make a deposit.

Opening a savings account is often an essential step in achieving financial stability and reaching your long-term savings goals. It offers a secure way to store your money while potentially growing your wealth over time.

“A good rule to live by is to save 10 percent of what you earn, and have at least three months' worth of living expenses saved up in case of an emergency.” Once your teen has a steady job, help them set up a savings program so that at least 10 percent of earnings goes directly into their savings account.

The seven percent savings rule provides a simple yet powerful guideline—save seven percent of your gross income before any taxes or other deductions come out of your paycheck. Saving at this level can help you make continuous progress towards your financial goals through the inevitable ups and downs of life.

At least 20% of your income should go towards savings. Meanwhile, another 50% (maximum) should go toward necessities, while 30% goes toward discretionary items. This is called the 50/30/20 rule of thumb, and it provides a quick and easy way for you to budget your money.

Those will become part of your budget. The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals. Let's take a closer look at each category.

How much is too much savings?

FDIC and NCUA insurance limits

So, regardless of any other factors, you generally shouldn't keep more than $250,000 in any insured deposit account. After all, if you have money in the account that's over this limit, it's typically uninsured. Take advantage of what a high-yield savings account can offer you now.

Alex Milligan, a marketing and growth specialist, believes that “to be on the right track, you should aim to have saved up at least $20,000 by your 25th birthday. This amount can be achieved through a combination of saving, putting money away in an investment account, starting a business or a mix of all three.”

That's because $250,000 is the limit for standard deposit insurance coverage per depositor, per FDIC-insured bank, per ownership category. If you keep more than $250,000 in your savings account, any money over that amount won't be covered in the event that the bank fails. The amount in excess of $250,000 could be lost.

However, it is still possible to lose money with a high-yield savings account, and it's important to be aware of that before transferring your savings into one of these accounts. There are two main ways you have the potential to lose money. The first is that you could lose out to inflation.

| Bank | Interest Rate of Savings Bank Account |

|---|---|

| Axis Bank | 3.00% - 3.50% |

| Bank of Baroda | 2.75% - 3.35% |

| IDFC First Bank | 3.50% - 4.00% |

| Bank of India | 2.75% - 2.90% |