What is the basic information of savings account?

A savings account is a type of deposit account provided by banks and financial institutions. It allows individuals to deposit and store their money while earning a certain rate of interest on the deposited amount.

What is BSBDA? The Basic Savings Bank Deposit Account or BSBDA is a Savings Account that does not have a minimum balance. In contrast, a BSBDA has a maximum account balance that has to be maintained.

A savings account is a deposit account designed to hold money you don't plan to spend immediately. This is different from a checking account, a transactional account meant for everyday spending, allowing you to write checks or make purchases and ATM withdrawals using a debit card.

A savings account is a type of bank account that allows you to safely store your cash while earning interest. It's offered by banks and credit unions, which use your deposits to fund loans and other investment activities. In return, the bank pays you interest on your balance.

Zero Balance or Basic Savings Account

This is similar to the regular Savings Account, but unlike that account, you are not required to maintain any minimum balance for this account. It does, however, come with an ATM/Debit Card for your daily transactions.

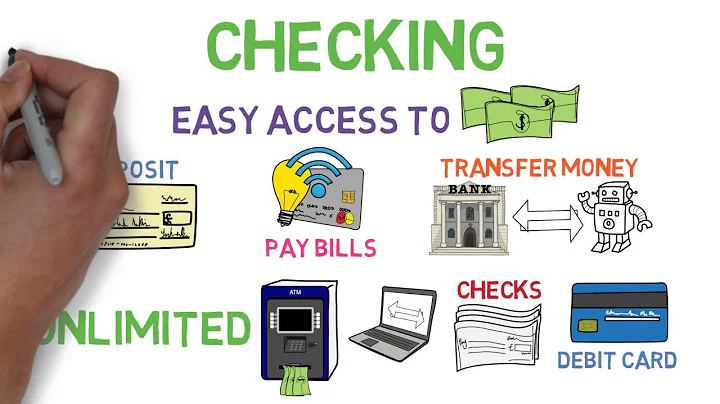

A basic bank account works like any bank or current account, so you can: receive payments, like wages, benefits and pension. pay for things or take out cash with a debit card. transfer money to pay bills or other people, including regular payments like Direct Debits and standing orders.

| Name of Bank Account | Interest Rates |

|---|---|

| Standard Chartered Bank Basic Banking Savings Account | 2.75% |

| IDFC First Bank Pratham Savings Account | 3.00% |

| HDFC Bank BSBDA | 3.00% |

| YES Bank Smart Salary Advantage | 3.50% |

The interest rate on savings generally is lower compared with investments. While safe, savings are not risk-free: the risk is that the low interest rate you receive will not keep pace with inflation. For example, with inflation, a candy bar that costs a dollar today could cost two dollars ten years from now.

In addition to earning interest, money in a deposit savings account is readily available. One of the biggest advantages of a savings account is that your money is fully accessible to you. You have access to your money through an ATM, online banking, our mobile app, or a transaction with a teller at one of our branches.

Because it usually provides interest, allows for easy withdrawals, and is insured, a savings account is most useful for money that you would need in the near future.

Who is eligible for basic savings account?

The following people are eligible to open a Basic Savings Bank Deposit Account: Resident Individuals (sole or joint account) Hindu Undivided Families. Customer should not be having existing BSBD Account with any other Bank.

- Interest Rates Can Vary. Interest rates for both traditional and high-yield savings accounts can vary along with the federal funds rate, the benchmark interest rate set by the Federal Reserve. ...

- May Have Minimum Balance Requirements. ...

- May Charge Fees. ...

- Interest Is Taxable.

Savings Bank account shall not be opened in the name of the following: a. Any trading or business concern, whether such concern is proprietorship, partnership, company or association.

What is a basic bank account. With a basic bank account, you can have your income paid in and manage your money with the Barclays app, online, in a branch and by phone. You can make payments, withdraw cash and set up regular payments like Direct Debits and standing orders.

You'll need some form of ID and proof of address to open an account. You can open a basic bank account in branch, or sometimes online or over the phone, depending on the bank. As well as filling in an application form, you'll be asked to show some ID, and proof of address.

This means that to open a basic bank account you must provide documents to prove your identity and address. You can prove your identity to your bank by showing them, for example, your: • passport • driver's licence. Banks can accept other forms of identification or proof of address.

- Advantages.

- Earn Interest. A savings account helps you earn interest on the deposited amount. ...

- Safest Investment Option. ...

- Minimum Investment Amount. ...

- Disadvantages.

- Interest Rates Can Change. ...

- Easy Access. ...

- Minimum Balance Requirement.

Typical minimum account balance requirements for traditional savings accounts range from $300 to $500, although amounts vary and some banks have no minimum requirements. The minimum balance amount may be a minimum daily balance or a minimum monthly average.

A minimum opening deposit is a certain amount of money—usually $25 to $100—that a bank or credit union requires you to deposit to open a checking or savings account.

Most financial experts suggest you need a cash stash equal to six months of expenses: If you need $5,000 to survive every month, save $30,000. Personal finance guru Suze Orman advises an eight-month emergency fund because that's about how long it takes the average person to find a job.

What is the safest type of savings account?

Certificates of deposit: These accounts lock your balance away for a specified period of time — often between one year and five years — in exchange for a higher interest rate. But if you withdraw any money during the term, you'll typically have to pay a penalty. CDs are also covered by FDIC insurance.

3 Lakh in your savings bank account as the cash deposit limit in savings account as per income tax is Rs. 10 Lakh in a year. But you can't deposit the total amount in a single day as the cash deposit limit in savings account per day is just Rs. 1 Lakh.

But if you're looking to set aside money for future needs and goals, opening a savings account is an option to consider. Saving a percentage of your income and putting it into a savings account can help you grow your savings while building a safety net fund.

A savings account is also helpful for covering any immediate financial goals you want to achieve over the next two years. You can access your money whenever you want, and in the meantime it sits in a stable FDIC-insured account.

A savings account is a safe place to put your money when you can't afford to lose any or think you'll need it in an emergency. It's also a good place to put some of your investments as a hedge against losses – you can't lose everything if some of your money is in an ordinary savings account, after all.